For the last few decades, the federal government has offered homeowners tax credits for installing rooftop solar arrays. Those credits are set to go away at the end of this year, thanks to President Donald Trump’s One Big Beautiful Bill Act.

It also sunsets incentives for commercial projects and scales back incentives for battery storage.

It’s a move local solar developers and regulators say will throw Vermont’s industry into turmoil, put upward pressure on electric rates and hurt burgeoning programs to help low-income households own solar.

Impacts on Vermont’s residential solar industry

A typical residential rooftop solar array costs between $20,000 and $30,000, said Peter Sterling, with the trade group Renewable Energy Vermont.

The federal tax credit for residential rooftop solar projects has been around in some form since the early 1990s, but was expanded under the Biden administration so that homeowners could recoup 30% of the cost of a project in tax breaks, and more if they also installed batteries.

Under the new law, those credits will go away altogether at the end of this year, repealing decades of incentives that previously enjoyed bipartisan support. (The commercial solar tax credit is set to sunset in 2027, and the One Big Beautiful Bill Act also restricts tax incentives for batteries starting next year.)

Alexander Mintz owns Power Guru, a Bennington-based company that installs solar arrays and battery systems in Southern Vermont. He expects many small and medium-sized solar developers in Vermont will go out of business or have to turn away rooftop solar customers.

Power Guru is anticipating a pretty serious blow to their business in 2026, Mintz said, and will face tough choices that could affect their 10 employees.

“They are not limited to downsizing,” Mintz said. “We’re going to try to avoid that by training quickly on other technologies that we might be able to offer, but there is a lot of uncertainty about whether or not those transitions will amount to sustainable revenue.”

More from Brave Little State: How much does Vermont's power grid depend on fossil fuels?

He said the company could pivot to installing heat pumps and doing HVAC work — though federal incentives for those efficiency technologies are also targeted by the new law.

The removal of tax credits could also have broader implications for the state’s economy: The renewable energy sector employs about 18,000 people in the state, or about 6% of Vermont’s workforce. That’s the highest per capita share of any state in the country.

Those projects that have complications, have longer lead time, have more bureaucracy to get through … will suffer.Jarred Cobb, Catamount Solar

Jarred Cobb of Randolph’s Catamount Solar said the changes will also make it harder to find developers willing to work on projects that serve lower-income households and affordable housing developments.

“Solar companies will have to focus on their profitability,” he said. “Those projects that have complications, have longer lead time, have more bureaucracy to get through … will suffer.”

On the flip side, many local solar companies have seen growth in recent years, and could see a very good 2025, as people scramble to leverage federal tax credits before they expire by the end of the year.

Impacts to programs for low-income solar

The loss of federal tax credits also has a ripple effect on the Solar For All program, which is meant to help low-income households get solar for free and make affordable housing developments more energy efficient.

It’s part of a $7 billion nationwide effort to lower household energy costs for families that spend a high share of their income on their energy bills.

Vermont received $62 million in federal funds to launch its program this year.

But state Solar For All director Melissa Bailey said federal solar tax credits were a critical part of how the state planned to stretch those federal funds.

“The unfortunate impact there is we’ll just be able to have fewer participants in the program,” Bailey said.

More from Vermont Public: 5 ways to lower your energy costs and carbon emissions as a renter

Because many lower-income households don’t have the tax liability to benefit from a tax break, the program hoped to recruit investors to take on the liability, allowing those households to get solar installed for free or at a very low cost.

Absent that financing tool, she said the state could be forced to cut the number of individual households it serves through that aspect of Solar for All by between a quarter and a third.

Meanwhile, the elimination of the commercial tax credit in 2027 could put a damper on solar installations for affordable housing projects, which often take longer to build and permit.

Impacts for all ratepayers

And while small businesses and low-income households will feel a more immediate impact, the loss of solar and battery tax credits will put financial pressure on all electric ratepayers.

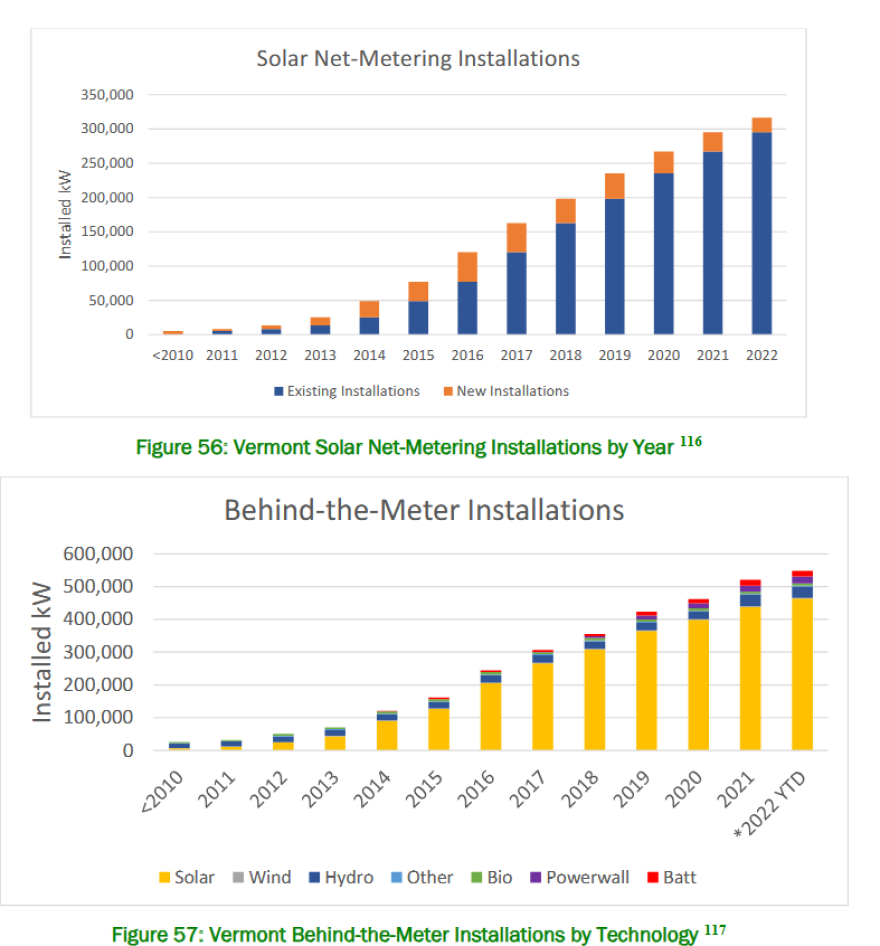

Vermont has committed by law to source 100% of its electricity from renewable resources by 2035, with 20% of that power coming from new renewables in the region by 2035. Most of that is expected to come from new solar — much of it installed by utilities, who are also poised to lose out on solar tax credits by the end of 2027.

TJ Poor, with the Department of Public Service, said eliminating the federal tax credits for residential and commercial solar will make it more expensive for Vermont to reach its climate commitment in the electric sector.

More from Vermont Public: Vermont’s new climate plan enters a challenging political landscape

“Those are costs that would otherwise have been borne by the federal government, which are not the shared responsibility of solar developers and ratepayers,” Poor said.

The Department estimates electric rates will increase by 25% by 2030. Poor said the elimination of federal incentives for solar will only put more pressure on rates.

So too will uncertainty about offshore wind, at a time when many utilities in the state are preparing to renegotiate their long-term contracts for purchasing power from generators in southern New England and Hydro-Québec.

Demand for power in New England is expected to increase by about 10% over the next decade. Poor says the elimination of tax credits won’t slow the deployment of renewables in Vermont, thanks to state regulations requiring them.

But it could decrease supply region-wide at a time when demand is going up, as people install heat pumps and electric vehicle chargers.

Renewable developers would like to see Vermont step in to subsidize residential solar as some other states have done, including neighboring New York — whether through state tax credits or increasing the credit that rooftop solar customers get on their electric bills.

But Poor and other Scott administration regulators predict there will be limited appetite for such a solution.

“Vermont is facing cost pressures across the board,” Poor said. “You can just go down the list right now, and adding a one-for-one replacement of these tax credits would be a challenge because it would be more cost for either ratepayers or taxpayers, depending on how you structure it.”