Back in January, Gov. Phil Scott leveraged the gains his Republican party made in the last election to come out swinging, demanding that lawmakers send him a bill this year that would transform Vermont’s K-12 system.

On Monday, legislative leaders did what Scott asked them to do. The landmark, 155-page bill they sent to his desk, which he plans to sign, would fundamentally upend how our schools are funded and governed.

The bill embraces the general constructs that Scott proposed when he laid out his vision for reform. As with the governor’s initial plan, H.454 would enact a foundation formula through which the state — not local voters — controls the bulk of school spending, and it paves the way for wide-scale consolidation.

Here’s a breakdown of what the bill would change.

School district size and structure

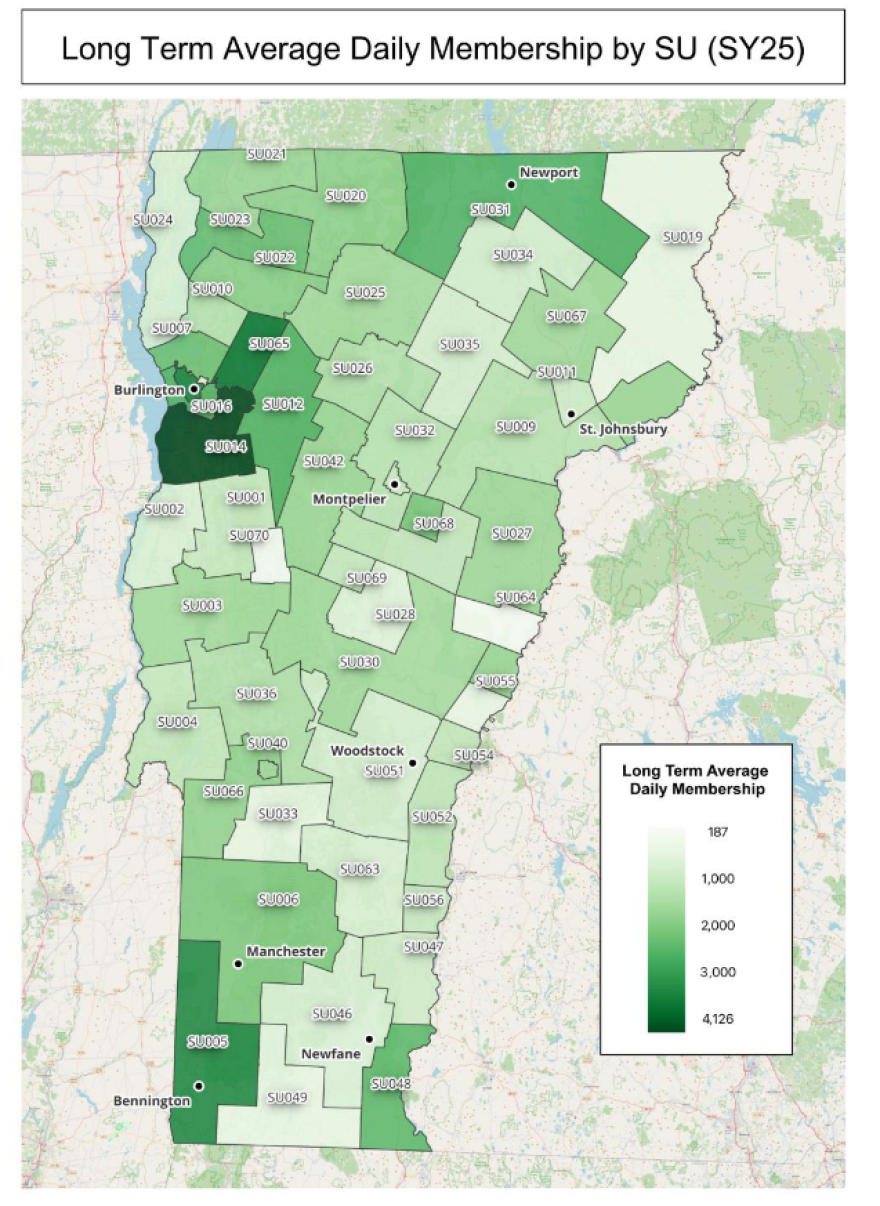

Current: 52 supervisory districts or supervisory unions (umbrella school districts), and 119 school districts, with anywhere between 180 to 4,100 students apiece.

H.454: Envisions school districts or supervisory unions with, “to the extent practical,” a minimum of 4,000 kids, and a maximum of 8,000 students.

New district maps don’t exist yet. An 11-member panel made up of six lawmakers and five retired superintendents and school business managers must recommend three redistricting options to the Legislature this December.

Minimum class sizes

Current: There are no statutory minimums, but some school districts have started adopting minimums voluntarily.

H.454: The State Board of Education could move to close a school if it doesn’t meet minimums for three years in a row. It would have the option to provide waivers to schools that they determine are geographically isolated. There are also exceptions for certain courses and subjects.

The minimum standards would be 10 students for grade 1; 12 students for grades 2-5; 15 students for grades 6-8; and 18 students for grades 9-12. Multi-age classrooms for grades K-8 would be limited to two grades per classroom.

Spending decisions

Current: Local voters decide what to spend, and receive that amount from the state’s education fund.

H.454: The state would control most school spending. This would be done through a per-pupil grant, with a base amount for every student and extra money for certain kinds of kids, like those living in poverty or who are learning English. The base amount per student in the bill right now is $15,033, but that number is expected to be revised following a slew of studies. It’ll also be adjusted for inflation over time.

Local voters could approve some extra spending. But not much. Supplemental spending would eventually be capped at 5%.

School taxes

Current: A Vermont resident’s primary home is taxed at the homestead rate, and then there’s a non-homestead rate that’s applied to all other types of property. You can also get a break on your homestead taxes via a tax credit that’s pegged to your household income.

H.454: In addition to homestead and non-homestead, this bill would create a third category of property: “non-homestead residential.” The intent is to allow lawmakers to raise taxes on second homes — and use that money to help take the pressure off everyone else.

This bill would also get rid of that income-sensitive tax credit for homestead taxes and instead replace it with a tax exemption, also based on income. This change is intended to smooth benefit cliffs that you see in the current income-sensitivity system.

Independent schools

Current: In non-operating districts, students are tuitioned to the public or independent school of the family’s choice. There are few guardrails about where students can go with their vouchers — and in some rather controversial (but entirely legal) cases, families have used them to subsidize prep school tuition out-of-state and even overseas.

H.454: Enacts significant restrictions on which private schools can take public money, including by barring any out-of-state schools. Families also wouldn’t be able to use vouchers to pay for an independent school if that school is located in a school district where there’s a public alternative.

Would this reduce my property taxes?

The intent of this legislation is to reduce taxes for most Vermonters. But whether your taxes go up or down will depend on a lot of factors. Will your household income, for example, qualify you for a partial exemption? Right now, the cut-off is set at $115,000, but lawmakers are studying whether to increase that. And whether or not your district approves extra spending would also impact your rate.

There was a lot of concern in the lead-up to the bill’s passage that it could potentially raise taxes in communities that currently spend well below the state average. That’s because those low-spenders — whose taxes are also lower as a result — will be brought up to a more uniform average.

Lawmakers say they believe that in the end, taxpayers will be better off with this legislation than they are today. But basically all spending and taxing provisions in this bill are subject to revision. So it’ll be impossible to know how Vermonters will be impacted until we’re closer to implementation.

When would this all happen?

This bill will be implemented over several years, and different provisions take effect at different times.

Class size minimums, for example, take effect really soon: July 1, 2026. But other parts of the bill are further away. The foundation formula wouldn’t start coming online until July 1, 2028, and will be phased in over a five-year period.

It’s also important to note most of this — including the new funding formula — is contingent. If lawmakers don’t adopt new school district maps, the foundation formula goes away, as does the tax on second homes.

That’s why a lot of people don’t think these reforms are a done deal, even though there’s no doubt H.454 will become law. And they’re gearing up for a big fight next year.