In just six weeks, Vermonters will embark on a brand new way to purchase health insurance. They'll be signing up through the state's new health care exchange for coverage that starts in January.

Many consumers and small businesses have a lot of questions about how this new system is going to work and what it means for them in the future.

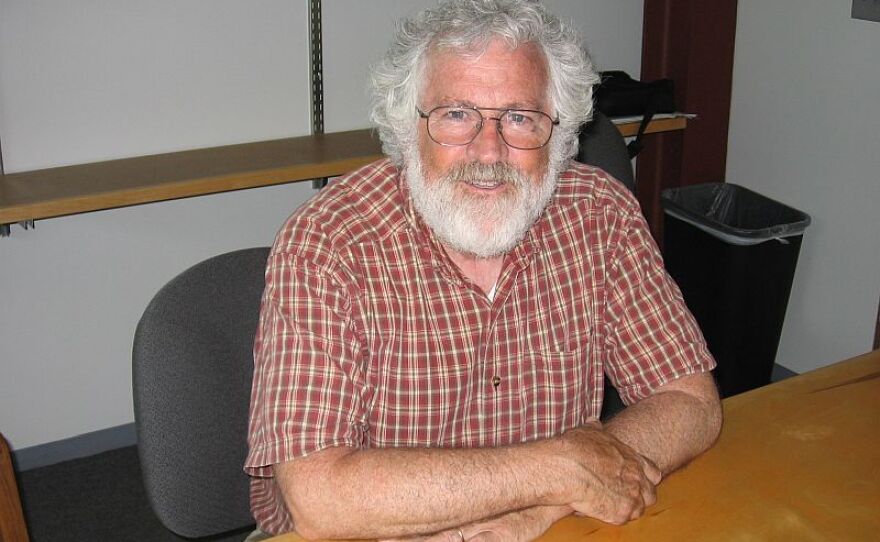

Mark Larson, the commissioner of the Department of Vermont Health Access, kicked off a recent briefing on the status of the state’s health care exchange, known as Vermont Health Connect.

“Welcome everybody. Thank you for joining us. We realize that we’re in an environment where there’s a lot going on and a lot happening fairly quickly,” he said.

We stand here today still confident that we are on track for success in October with the implementation of Vermont Health Connect - Health Access Commissioner Mark Larson

Beginning in January, all individuals, and businesses with fewer than 50 employees will have to go through the exchange if they want to purchase health insurance.

Vermont Health Connect is scheduled to start its enrollment process on October 1 and Larson wants Vermonters to know that it will be ready.

“We stand here today still confident that we are on track for success in October with the implementation of Vermont Health Connect,” said Larson.

The exchange has been compared to a travel website. Two companies, Blue Cross and MVP are each offering nine different policies. All the policies have the same benefit package but they have different potential out of pocket expenses.

The policies are grouped by four metals; platinum, gold, silver and bronze. Platinum has the lowest out of pocket risk, and as a result, the highest premium, and the bronze policy has the largest out of pocket risk and the lowest premiums.

Federal subsides are available to help make this coverage more affordable. The eligibility cap for an individual is roughly $45,000, for a couple it’s $60,000, and for a family of four it’s $92,000.

For instance, a person making $35,000 a year would pay roughly $230 dollars a month for a Bronze policy that has an out of pocket maximum of around $4,000.

Larson says the exchange gives consumers a chance to make a direct comparison of policies.“Vermont Health Connect will be a new way for Vermonters to have access to side by side comparisons of health insurance plans,” said Larson. “And a way to find out if they’re eligible for financial help to help pay for their health and enroll in a plan all in one place.”

One person keeping a close watch on the developments of the exchange is David Healy, vice president of Stone Environmental. His company is located in a new business district in Montpelier along the banks of the Winooski River.

Because Healy has 46 employees, his business needs to go through the exchange to offer insurance to its workers.

Healy has been to some information meetings and he thinks he’s found a policy that closely matches the coverage that his employees have today.

“I think I can cautiously say I know what we are going to do but I’m trying to get some more feedback and learn a little bit more,” said Healy. “But I think what I saw and heard it made me pretty confident that it’s a path forward in the exchange.”

Currently, Healy can offer a single type of policy to all of his employees but he thinks this option might change under the exchange.

“Of the two plans that are on the exchange, the company can say one or the other. Do the employees get to pick any of the four plans in that that’s the one I’m less certain about,” said Healy. “And if they do then I have to do some fancy accounting to figure out how to make it come out whole for both all the employees as well as the company.”

Robin Lunge is the director of Health Care Reform for the Shumlin Administration. She says the exchange is designed to give employees more choice.

She says Healy can designate Blue Cross or MVP as the company’s insurance carrier. But once he’s made that choice, his employees are free to sign up for any policy offered by the company. Or Healy can give his employees access to both carriers.

Lunge says giving employees these choices will not necessarily raise costs for Healy because he can establish a set amount that his company is willing to provide for each employee. If the employee chooses a more expensive plan, then the employee will have to pay a higher premium.

“So this is a change that employees would now have a choice of plans,” said Lunge. “And the employer can pick a plan to set their contribution to so that the employer has a set amount they can count on for their budget.”

Healy says it’s important for his company to offer good health insurance coverage to its employees but he says it’s a job that’s time consuming, and an administrative challenge. He’s hoping that the new health care exchange will make this job a little easier.

Not all businesses are comfortable with the switch to the exchange. Read the second part of this series here.