It’s 9:30 in the morning. Tashya Harrell, a 51-year-old woman from Harlem, is standing outside of a rusty brown and beige brick building.

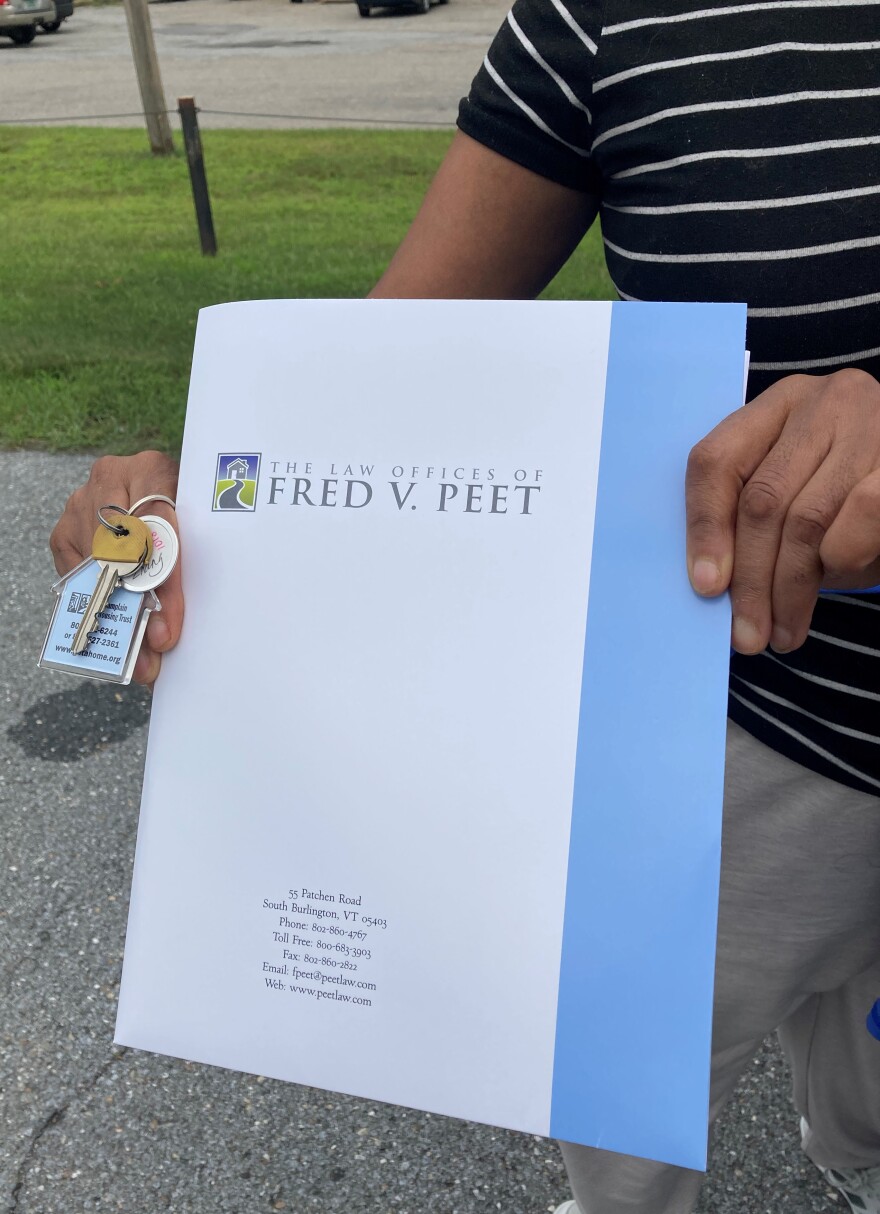

She’s about to do a final walk-through of her soon-to-be home.

“This is my first place too, so this is like, yeah, first," she says. "I don't want to, again, very leery about making a mistake and doing things or saying yeah, 'That's great.'"

With Vermont’s rapidly increasing home prices and historically low home availability, she says she felt like she was running out of options.

“I'm like, 'Oh, man, I'm never gonna find a place.' [I was] very discouraged because I was like, 'I can't even afford a place and I'm working full-time,'” she says. “Like, why can’t I afford rent? You know? So it was like, super frustrating.”

Then Tashya learned about the Champlain Housing Trust’s Homeownership Equity Program. It was announced in June after receiving $3 million from the New England Federal Credit Union to get started.

Applying was her last hope to stay in Vermont.

“When this came along, I said, 'Look, if I don't get a place, I'm moving back to New York,'" Tashya says. "So now moving, like down back there, because, as you know, there's not a lot for us."

The new initiative builds upon another program the housing nonprofit has run for over 30 years — the Shared Equity Program. In a nutshell, it provides an affordable route to purchasing a home.

“I think of it as like another step along the housing continuum for people who want to not only want to stay here, but they want to take that next step from renting to owning their own home and to putting down roots,” says Julie Curtin, director of homeownership with the Champlain Housing Trust.

Legacies of restrictive housing policies and discriminatory lending practices have made it difficult for Black households to buy a home.

For example, until outlawed by the Fair Housing Act in 1968, real estate developers would use exclusionary housing covenants to keep new subdivisions segregated.

These were included in deeds to prevent homes from being sold to groups of people based on race, ethnicity or religion.

While nationally, close to 40% of Black households are homeowners, in Vermont just a quarter of Black households own a home.

“A big barrier to access to homeownership is the cost of simply the transaction itself, legal fees, etc. And so we designed this program to really reduce that barrier and eliminate it."Julie Curtin, Champlain Housing Trust

Curtin, with the Champlain Housing Trust, says the program aims to create a bridge to homeownership by offering a down payment assistance loan of up to $25,000.

“A big barrier to access to homeownership is the cost of simply the transaction itself, legal fees, etc. And so we designed this program to really reduce that barrier and eliminate it,” she says.

If the buyer owns and lives in their home for three years or more, the loan is forgiven. They can use the funds to pay the costs of buying the home and borrow less money from the bank to build home equity.

The shared equity staff also provides a home buying workshop to walk applicants like Tashya through the credit process and shopping for mortgages.

“Through counseling and education, we want to be able to sort of strengthen and make sure that if you are a Black homeowner, you have that support right now, so you can be successful,” says Michael Monte, the CEO of the housing trust.

According to a recent report from the state’s housing finance agency, Vermont has one of the highest homeownership gaps between Black and white residents in the U.S.

Monte says they wanted to specifically target that gap.

“That program required us to be fairly rigorous around looking at the issue of racism and housing, in Vermont, and then place it in the areas that we worked,” he says.

The Champlain Housing Trust got some initial pushback from white Vermonters, but Monte says early results show the program is doing what it is supposed to. Since June, four homes have been purchased in the program, with three more waiting to close.

“I think that this program is sustainable. I think it has value. And I think it'll show its value in the number of BIPOC folks who become homeowners as a result of this particular program,” Monte says.

It has been about a month since Tashya Harrell closed on her new condo, and she’s getting settled in.

“I'm doing really good. I'm loving it. I painted, I'm totally moved in,” she says. “But I'm still buying stuff, and you know, stuff like that, but it feels good.”

Tashya and her Yorkie Terrier roommate Sasha are happy to finally have a place to call their own.

Disclosure: New England Federal Credit Union is an underwriter for Vermont Public.

Have questions, comments or tips? Send us a message or get in touch with reporter Marlon Hyde @HydeMarlon.